All Categories

Featured

Table of Contents

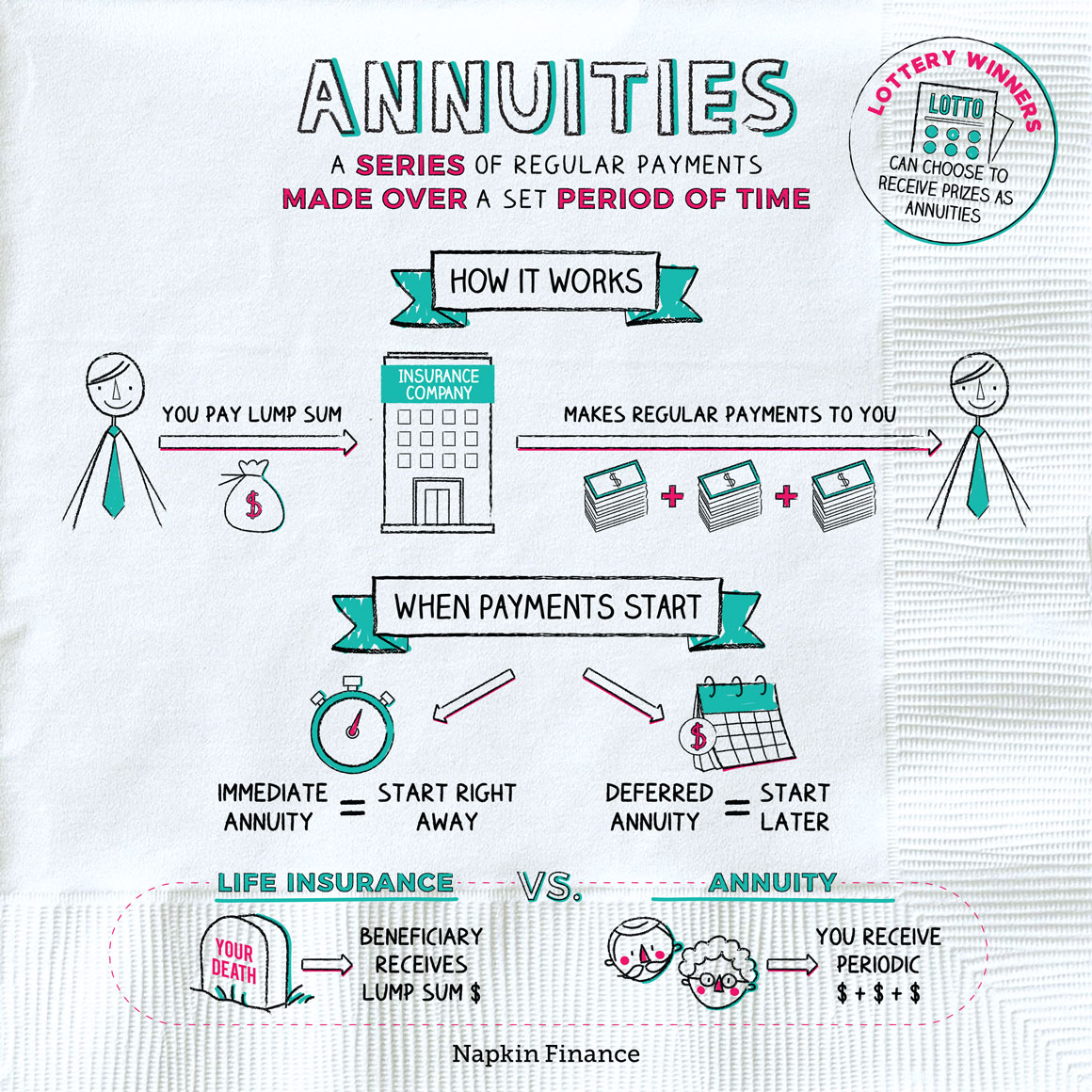

Annuities are insurance coverage products that can get rid of the risk you'll outlast your retirement savings. Today, considering that less individuals are covered by standard pension plans, annuities have actually ended up being increasingly prominent. They can often be incorporated with various other insurance policy items, like life insurance coverage, to create full security for you and your household. It prevails today for those approaching retirement to be concerned about their savings and for how long they will certainly last.

There will certainly constantly be earnings for as lengthy as you live. That provides many people useful peace of mind. You make a premium payment to an insurance provider, either in a round figure or as a collection of repayments. In return, you'll obtain routine revenue for a specific period, typically forever.

We're living much longer, and future costs are unpredictable, so retired life has ended up being a huge concern mark in people's lives. If you're concerned regarding your retirement savings lasting, annuities could be a great idea. Every sort of retirement financial savings vehicle has pros and cons. Annuities are no different. Take a look at several of the primary advantages of annuities compared to various other retirement financial savings cars: Annuities are the only monetary item that can offer you with guaranteed life time earnings and make sure that you are never in jeopardy of outliving your cost savings.

As holds true with numerous retired life cost savings lorries, any kind of earnings on your delayed annuity are tax-deferred. That means you don't pay tax obligations on the growth in your account until you withdraw it or start taking payouts. Simply put, the tax obligations you 'd normally owe on the gains annually stay in your account and grow, usually leaving you with higher balances later on.

How do I choose the right Annuities for my needs?

1 To locate the very best item for you, you'll need to search among trusted insurance policy suppliers. Among the benefits of annuities is that they are highly personalized. The appropriate annuity for you is going to rely on several variables, including your age, your current savings, the length of time you need the earnings, and any kind of securities you might desire.

2 Below are a number of typical instances: You and your partner are planning to retire within the following couple of years. You've both saved an excellent quantity however are currently attempting to crisis the numbers and make certain your financial savings will certainly last. It prevails to stress over just how much of your cost savings to access yearly, or how much time your savings will certainly require to last.

3 This way, you and your spouse will certainly have income you can count on no matter what occurs. On the various other hand, allow's claim that you remain in your late 20s. You have actually lately had a nice raise at the office, and you want to make certain you're doing every little thing you can to guarantee a comfortable retired life.

Retirement is a long way off, and that knows just how much those cost savings will expand or if there will certainly be enough when you reach retirement age. Some annuities permit you to make superior payments every year.

How much does an Annuity Riders pay annually?

The annuity will certainly have the possibility to experience growth, yet it will also be subject to market volatility. New York Life has several choices for annuities, and we can assist you customize them to your household's special demands.

There are two basic kinds of annuity contracts: instant and delayed. An immediate annuity is an annuity agreement in which settlements begin within 12 months of the day of purchase.

Regular settlements are deferred up until a maturation date stated in the agreement or, if earlier, a day picked by the owner of the contract - Annuity interest rates. One of the most common Immediate Annuity Agreement payment alternatives consist of: Insurance firm makes regular settlements for the annuitant's life time. An option based upon the annuitant's survival is called a life set alternative

There are two annuitants (called joint annuitants), normally partners and periodic payments continue till the death of both. The income settlement amount might proceed at 100% when just one annuitant is alive or be reduced (50%, 66.67%, 75%) during the life of the enduring annuitant. Periodic payments are produced a given amount of time (e.g., 5, 10 or twenty years).

Why is an Annuity Withdrawal Options important for long-term income?

Revenue settlements cease at the end of the period. Repayments are generally payable in set buck amounts, such as $100 monthly, and do not provide protection against inflation. Some instant annuities provide inflation protection with regular boosts based upon a set price (3%) or an index such as the Consumer Rate Index (CPI). An annuity with a CPI change will certainly begin with lower payments or require a greater preliminary premium, however it will supply at the very least partial defense from the danger of inflation.

Revenue payments stay constant if the financial investment efficiency (after all costs) equates to the assumed investment return (AIR) stated in the contract. Immediate annuities generally do not allow partial withdrawals or provide for cash money abandonment advantages.

Such persons need to seek insurance providers that use second-rate underwriting and take into consideration the annuitant's health standing in determining annuity revenue settlements. Do you have enough financial resources to fulfill your income requires without buying an annuity?

Who provides the most reliable Annuity Income options?

For some choices, your health and wellness and marital condition might be thought about. A straight life annuity will certainly offer a higher month-to-month earnings settlement for an offered premium than life contingent annuity with a period specific or reimbursement feature. To put it simply, the cost of a specific income settlement (e.g., $100 monthly) will certainly be higher for a life contingent annuity with a period specific or reimbursement attribute than for a straight life annuity.

A person with a reliant partner might want to consider a joint and survivor annuity. A person worried about obtaining a minimal return on his or her annuity premium may want to think about a life section choice with a period specific or a refund attribute. A variable immediate annuity is commonly picked to keep pace with inflation during your retirement years.

A paid-up deferred annuity, likewise frequently referred to as a deferred earnings annuity (DIA), is an annuity contract in which each premium payment purchases a set dollar revenue benefit that commences on a specified date, such as an individual's retirement date. The agreements do not preserve an account value. The premium price for this product is much less than for an immediate annuity and it allows an individual to keep control over a lot of his/her various other properties throughout retirement, while protecting longevity protection.

Table of Contents

Latest Posts

Decoding Pros And Cons Of Fixed Annuity And Variable Annuity A Comprehensive Guide to Fixed Interest Annuity Vs Variable Investment Annuity What Is the Best Retirement Option? Pros and Cons of Various

Analyzing Strategic Retirement Planning A Comprehensive Guide to Fixed Annuity Vs Equity-linked Variable Annuity What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why Choo

Exploring Annuities Variable Vs Fixed Everything You Need to Know About Tax Benefits Of Fixed Vs Variable Annuities What Is the Best Retirement Option? Pros and Cons of Fixed Vs Variable Annuity Pros

More

Latest Posts