All Categories

Featured

Table of Contents

Trustees can be family members, relied on people, or financial establishments, depending on your preferences and the intricacy of the count on. The objective is to ensure that the count on is well-funded to fulfill the youngster's lasting economic requirements.

The duty of a in a child assistance count on can not be understated. The trustee is the private or organization in charge of handling the trust's assets and ensuring that funds are dispersed according to the terms of the trust fund contract. This includes ensuring that funds are utilized exclusively for the youngster's advantage whether that's for education, treatment, or day-to-day costs.

They have to additionally give routine reports to the court, the custodial parent, or both, depending on the regards to the trust. This liability makes certain that the trust is being managed in a manner that benefits the kid, avoiding misuse of the funds. The trustee also has a fiduciary obligation, meaning they are lawfully bound to act in the finest passion of the youngster.

By purchasing an annuity, moms and dads can make sure that a fixed amount is paid on a regular basis, no matter any fluctuations in their income. This gives comfort, recognizing that the child's demands will remain to be met, no matter the economic situations. One of the key benefits of using annuities for youngster assistance is that they can bypass the probate process.

Deferred Annuities

Annuities can likewise use protection from market fluctuations, making certain that the kid's financial backing remains secure also in unpredictable financial conditions. Annuities for Youngster Assistance: A Structured Service When establishing, it's vital to consider the tax effects for both the paying parent and the youngster. Trusts, relying on their framework, can have different tax obligation therapies.

In other instances, the recipient the youngster may be accountable for paying tax obligations on any type of circulations they obtain. can also have tax effects. While annuities offer a secure income stream, it is very important to comprehend how that income will certainly be exhausted. Depending upon the structure of the annuity, settlements to the custodial moms and dad or child may be considered gross income.

Among one of the most substantial advantages of making use of is the capability to protect a kid's economic future. Trust funds, in particular, offer a level of security from financial institutions and can ensure that funds are used properly. A trust can be structured to make sure that funds are just utilized for certain functions, such as education or health care, stopping misuse.

Where can I buy affordable Annuities?

No, a Texas child assistance trust fund is specifically made to cover the kid's vital demands, such as education, health care, and daily living expenditures. The trustee is legally bound to ensure that the funds are made use of exclusively for the benefit of the youngster as detailed in the depend on agreement. An annuity offers structured, predictable repayments gradually, ensuring constant economic assistance for the youngster.

Yes, both youngster assistance trust funds and annuities featured potential tax obligation ramifications. Count on earnings might be taxed, and annuity settlements could additionally undergo tax obligations, depending on their structure. It's vital to speak with a tax obligation specialist or monetary advisor to comprehend the tax obligation duties connected with these monetary tools.

How does an Variable Annuities help with retirement planning?

Download this PDF - Sight all Publications The elderly person population is large, expanding, and by some quotes, hold two-thirds of the private wealth in the United States. By the year 2050, the variety of senior citizens is projected to be almost twice as big as it was in 2012. Considering that many senior citizens have actually been able to conserve up a nest egg for their retirement years, they are commonly targeted with fraud in a manner that younger people with no financial savings are not.

In this atmosphere, customers must equip themselves with info to safeguard their rate of interests. The Attorney General offers the adhering to tips to think about before buying an annuity: Annuities are difficult financial investments. Some bear complex qualities of both insurance coverage and safety and securities items. Annuities can be structured as variable annuities, repaired annuities, immediate annuities, postponed annuities, and so on.

Customers must check out and recognize the prospectus, and the volatility of each investment noted in the prospectus. Financiers ought to ask their broker to explain all terms and conditions in the prospectus, and ask concerns about anything they do not comprehend. Repaired annuity products may also bring dangers, such as long-lasting deferment periods, barring capitalists from accessing every one of their cash.

The Chief law officer has actually submitted legal actions versus insurance firms that marketed improper postponed annuities with over 15 year deferral durations to capitalists not expected to live that long, or that require accessibility to their money for healthcare or assisted living expenses (Fixed annuities). Capitalists ought to ensure they recognize the long-term consequences of any kind of annuity purchase

How do I receive payments from an Income Protection Annuities?

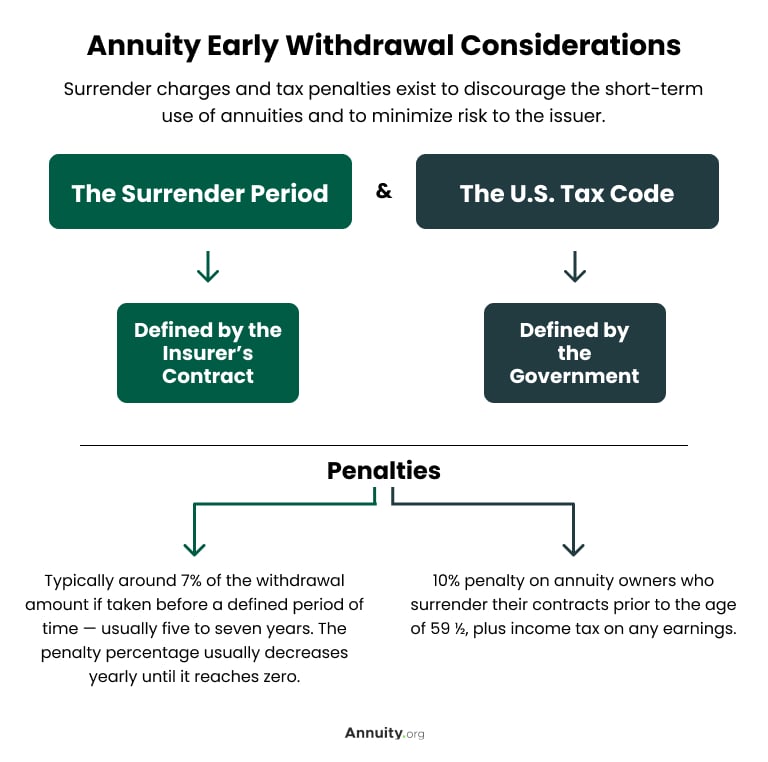

Be cautious of seminars that offer cost-free meals or presents. Ultimately, they are hardly ever totally free. Be careful of representatives that give themselves fake titles to improve their reliability. One of the most substantial charge connected with annuities is commonly the abandonment fee. This is the percentage that a consumer is charged if he or she withdraws funds early.

Consumers may desire to speak with a tax obligation expert before spending in an annuity. Furthermore, the "safety and security" of the financial investment relies on the annuity. Be careful of representatives who strongly market annuities as being as risk-free as or much better than CDs. The SEC alerts consumers that some vendors of annuities products urge consumers to change to another annuity, a practice called "spinning." Representatives might not adequately divulge fees linked with switching investments, such as new abandonment fees (which normally begin over from the date the product is changed), or significantly transformed benefits.

Representatives and insurer may offer bonuses to attract financiers, such as extra passion points on their return. The benefits of such "perks" are usually outweighed by raised costs and management costs to the capitalist. "Rewards" might be just marketing tricks. Some deceitful agents encourage consumers to make unrealistic investments they can't afford, or purchase a lasting deferred annuity, also though they will certainly need access to their cash for healthcare or living costs.

This section offers details beneficial to senior citizens and their households. There are many celebrations that might impact your benefits.

What does an Lifetime Payout Annuities include?

Key Takeaways The recipient of an annuity is a person or organization the annuity's owner assigns to obtain the agreement's survivor benefit. Different annuities pay out to beneficiaries in different methods. Some annuities might pay the recipient consistent repayments after the contract owner's fatality, while other annuities may pay a survivor benefit as a round figure.

Table of Contents

Latest Posts

Decoding Pros And Cons Of Fixed Annuity And Variable Annuity A Comprehensive Guide to Fixed Interest Annuity Vs Variable Investment Annuity What Is the Best Retirement Option? Pros and Cons of Various

Analyzing Strategic Retirement Planning A Comprehensive Guide to Fixed Annuity Vs Equity-linked Variable Annuity What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why Choo

Exploring Annuities Variable Vs Fixed Everything You Need to Know About Tax Benefits Of Fixed Vs Variable Annuities What Is the Best Retirement Option? Pros and Cons of Fixed Vs Variable Annuity Pros

More

Latest Posts